Today we’d like to introduce you to Lindsay Bryan-Podvin.

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

I started out as a social worker, doing what many social workers do, bopping between nonprofits and healthcare systems. I got more interested in managing my finances and enjoyed talking with friends and family about money. I realized many of my clients were struggling with their relationship with money and wanted to bring my love of mental health and money into the therapy room. I sought out additional training and got my certificate in Financial Social Work in May 2018.

I combine the financial literacy side of money with the emotional and psychological side of money. While much of my work is with couples and individuals in a financial therapy setting, I also consult other therapists and clinicians in private practice. So much of our work as helpers is sadly synonymous with being “underpaid,” and I believe we need to be well-compensated to take care of ourselves and others.

We all face challenges, but looking back would you describe it as a relatively smooth road?

As financial therapy is a relatively new field, I had to do a lot of education with my peers and other allied professionals to help them understand what financial therapy is. This also meant that potential clients who could benefit from financial therapy didn’t know financial therapy existed. I’d say a good part of the first 1-1.5 years of my business was educating others around me on what my work was and wasn’t. This meant a lot of unanswered pitches, lots of presentations, and guesting on podcasts to get my story out there.

As you know, we’re big fans of Mind Money Balance. For our readers who might not be as familiar what can you tell them about the brand?

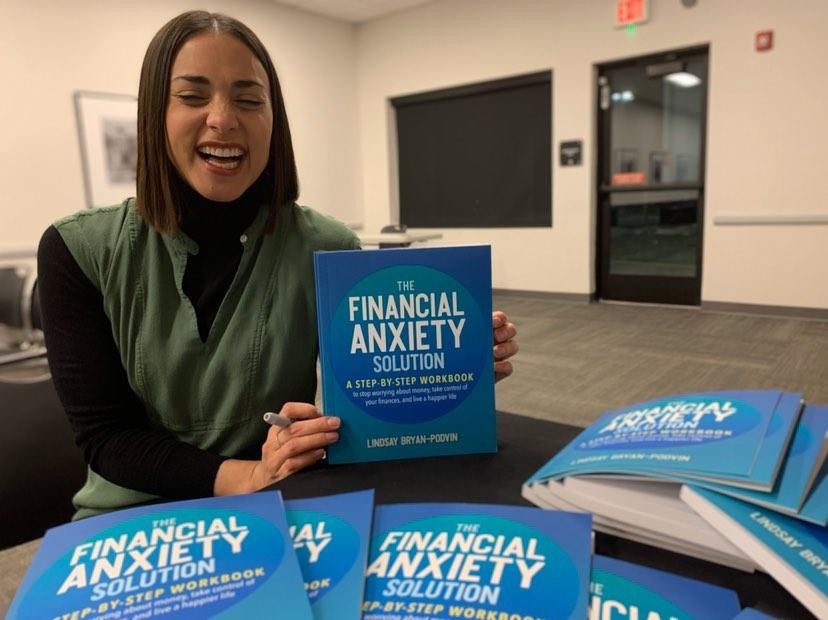

In my practice, Mind Money Balance, I use shame-free financial therapy to help people get their minds and money in balance. I work with individuals and couples who are in a relatively good place in their lives but are still struggling with having, earning, or spending money. As the author of the book “The Financial Anxiety Solution,” I love helping clients understand and manage their financial anxiety.

I offer several services: financial therapy, speaking engagements, coaching and consulting for other therapists or allied professionals in private practice, and recorded workshops on various topics for people just getting started exploring their relationship with money.

I’m a proudly mixed-race Filipina, an advocate of social justice, and believe money inherently intersects with race, politics, money, ability, and gender.

At Mind Money Balance, the belief is that practicing financial self-care affords us the ability to take care of ourselves emotionally, physically, and spiritually.

Do you have any memories from childhood that you can share with us?

I come from a large family, so I have many fond memories of my sisters and I packed into the kitchen, stumbling over bowls and utensils mixing up endless batches of brownies, cookies, and other sweets.

Contact Info:

- Email: [email protected]

- Website: www.mindmoneybalance.com

- Instagram: https://www.instagram.com/mindmoneybalance/

- Youtube: https://www.youtube.com/lindsaybryanpodvin

Image Credits

Image Credits

Maria Maldonado