Today we’d like to introduce you to Kayla.

Hi Kayla, it’s an honor to have you on the platform. Thanks for taking the time to share your story with us – to start maybe you can share some of your backstory with our readers?

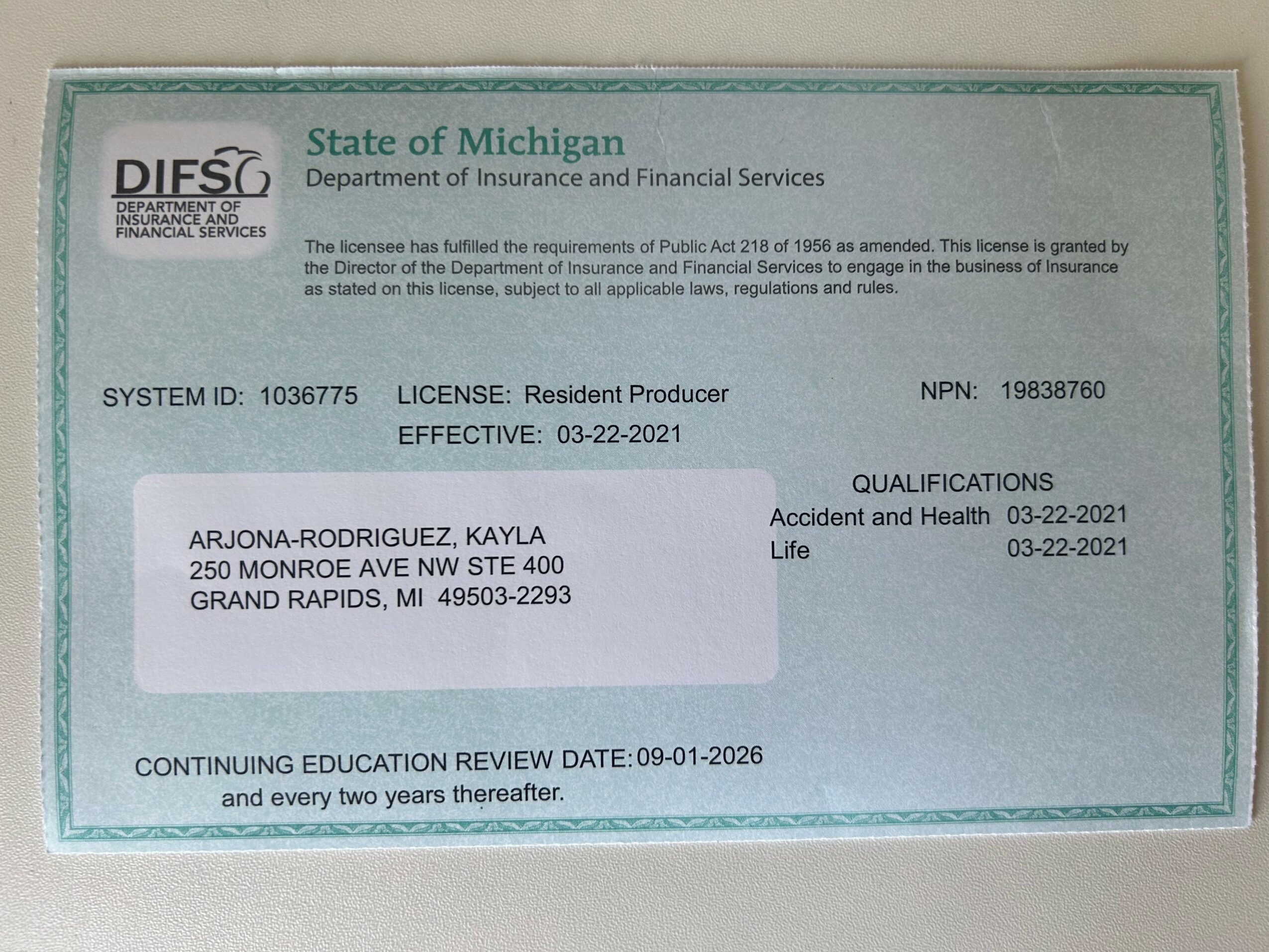

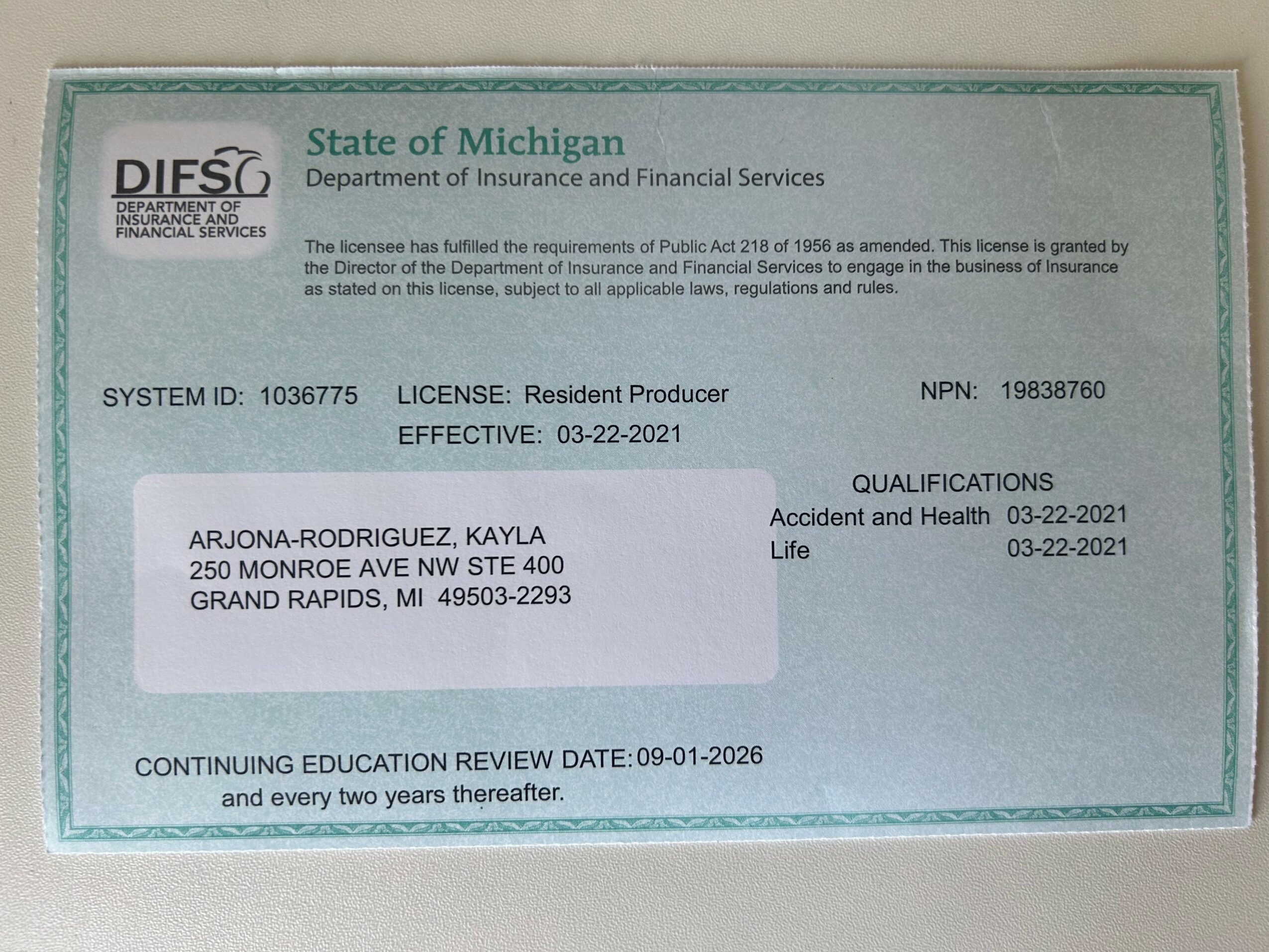

I came from humble beginnings. I grew up living with my grandma in a very small town. We lived in a condemned trailer without running water. This instilled hard work in me at a very young age. I always had this dream of living in an apartment downtown in a city one day. As the years passed and I stumbled through all the walks of life (graduating high school, graduating college, working in my first corporate job, getting married), I never lost sight of that goal. When I was 21, I was getting ready to study abroad in Sicily and take my MCAT. However, I went home to visit my grandma and I found her severely sick. I cancelled all of my plans and dedicated the next few years taking care of her. When she finally passed away in 2020, I was a little lost. I found my way working in insurance, which led to me getting a job at a top health insurance company in Grand Rapids. Just a few years later, my husband and I were living downtown Grand Rapids on the 11th floor overlooking the city, expecting our first child. My dream came true! However, it was at this point I decided I didn’t want to dedicate my motherhood to corporate America and daycares, and I decided to start my own insurance business. Today, I am building my business and brand, raising my 8 month old son with my husband, and living in my first house. My heart and soul could never be more full.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

It has been a very rocky journey! I had to pivot many times. I always wanted to be successful, but I didn’t know in what or how. My family was always important to me. I found myself taking steps back to make sure I had time to take care of them. While most 18-20 year olds were having fun with little responsibilities, I found myself as the main provider for my family, while also trying to work hard to excel one day in a career. Depression and anxiety knocked on my door on several occasions. Sometimes I would open it and let it consume me, but eventually I learned how to use it as a push forward in a better direction. I leaned in on inspirational people, like David Goggins and Jocko Willink, to get me through tough times. I hope to instill this sense of direction into my son one day.

Thanks for sharing that. So, maybe next you can tell us a bit more about your business?

Valora Benefits Group is a family owned insurance firm, specializing in Medicare, health insurance, group insurance and supplemental benefits. We understand the importance of protecting your family and loved ones, and because of that, we treat all of our clients like an extension of our own family.

Exploring insurance alone can be overwhelming, especially in today’s age where plans are constantly evolving. We simplify the process and find the best coverage for you at no extra cost. The insurance industry itself is filled with agents looking to make a quick buck. However, at Valora, whether you’re choosing a new plan, dealing with a claim, or just have a quick question, we are your go-to guide year-round. We keep things simple, save you time, and help you avoid costly mistakes. You can think of us as your personal insurance team, always just a call away.

Lastly, I started this business with my background and my family in mind. I will never forget that. As a result, we go to food pantries once per month and give back to our communities. Health and security for people will always be at the top of mind for Valora Benefits Group.

Risk taking is a topic that people have widely differing views on – we’d love to hear your thoughts.

I believe taking risks is how you make it in life. My background didn’t give me the time or the luxury to wait for thing to be perfect. When I had to jump, I had to jump. That philosophy drove me to start my business. At the time I decided to start my own business, I was being offered multiple six-figure roles from different insurance companies. I just had a baby, so many people would love to be in that situation. However, I knew that these roles would take me away from being a mother. So, I decided to cash out my 401K and JUMP. I made a plan, so I know the exact dollar amount I need to be making by January 2026 to keep my business open. However, if I fall short, I have backup options.

Pricing:

- Our services are always free. We get paid from the insurance companies. We would never charge for a service that can help change someone’s life – for the better.

Contact Info:

- Website: https://www.valorabenefits.com

- Instagram: https://www.instagram.com/valorabenefitsgroup/

- Facebook: https://www.facebook.com/profile.php?id=100083625518551

- LinkedIn: https://www.linkedin.com/company/valorabenefits/