Heath Biller shared their story and experiences with us recently and you can find our conversation below.

Hi Heath, thank you so much for taking time out of your busy day to share your story, experiences and insights with our readers. Let’s jump right in with an interesting one: Would YOU hire you? Why or why not?

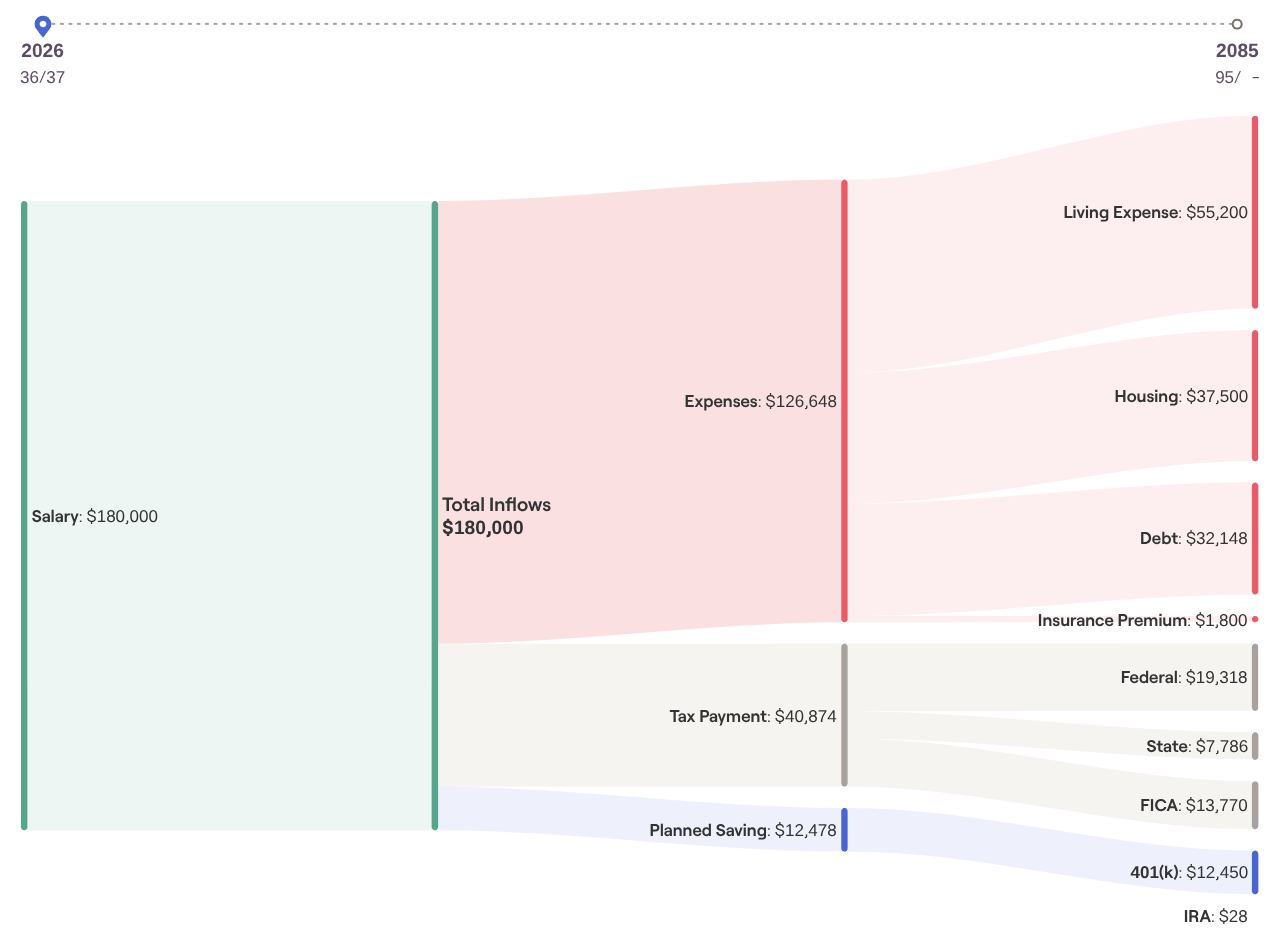

I probably wouldn’t hire myself, but only because I’m that person who genuinely loves diving into the weeds of tax-efficient investment strategies and data-driven planning. For me, managing my own finances is a fun hobby. But I realize I’m the outlier. Most of the Physicians, APPs, and Nurses I’ve worked with are, rightfully, focused on other important things, like providing exceptional patient care and spending time with their families.

Hiring an advisor isn’t just about knowing the right information; it’s about having the bandwidth and emotional discipline to actually implement it. If someone has the time, the tools, and the stomach to stay calm when the market gets bumpy, they might not need an advisor. But for someone who wants to reclaim their time or not worry about making a critical mistake with their financial future, that’s where hiring a financial advisor could make sense.

Can you briefly introduce yourself and share what makes you or your brand unique?

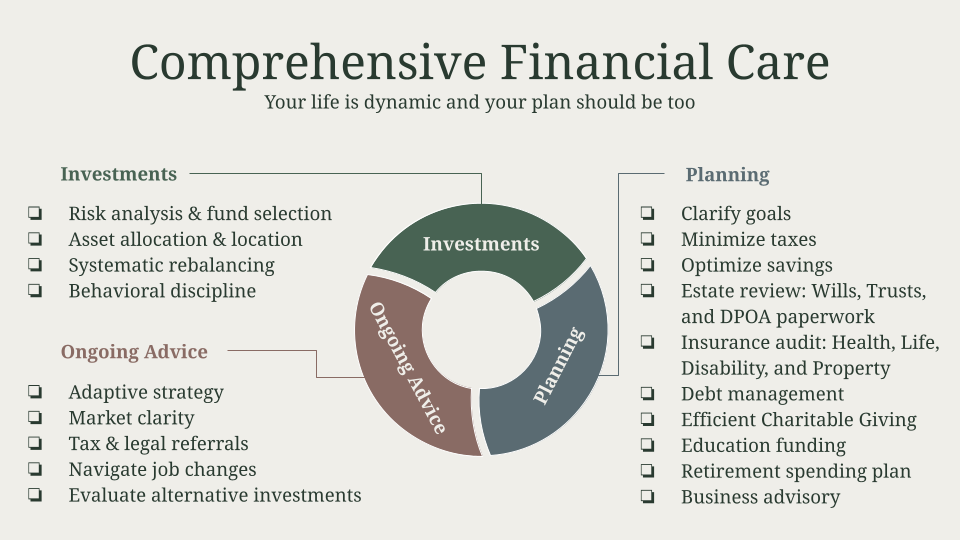

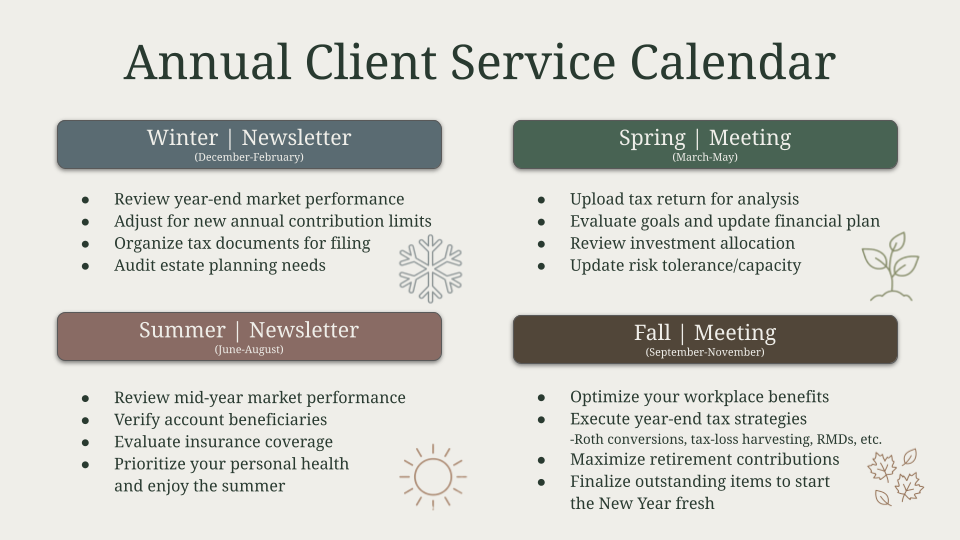

I spent over a decade in scrubs as a clinician, seeing firsthand how Physicians, APPs, and Nurses were experts at saving lives but often felt overwhelmed by their own financial futures. I founded my financial advising practice to partner with these professionals to help improve their financial health. To me, wealth is about more than just numbers; it’s about creating a balanced plan that supports well-being so people can reclaim their time, which is our most valuable asset. My mission is to take the guesswork out of investing by focusing on what I call the ‘Vitals Within Our Control’.

Just as patient care is evidence-based, I believe financial plans should be too. As a fee-only fiduciary, I am legally bound to put my clients first, mirroring the same oath my colleagues take to put their patients first. I leverage technology to keep the financial roadmap transparent, dynamic, and streamlined. Ultimately, my goal is to handle the financial ‘vitals’ so that my clients can focus on what matters most without the weight of worrying about all the details.

Appreciate your sharing that. Let’s talk about your life, growing up and some of topics and learnings around that. What breaks the bonds between people—and what restores them?

We live in an imperfect world where medical complications and market fluctuations are inevitable, yet the natural human instinct is often to retreat or avoid the conversation. But that silence is where trust goes to die. Whether it’s a clinician failing to update a worried family or an advisor going quiet when the market gets bumpy, a lack of communication creates a vacuum that people fill with their own fears and doubts.

Restoring those bonds requires honesty and timely communication. I’ve seen this in the hospital just as much as I see it now in the financial advising world. Trust is rebuilt when you have the courage to step into the challenge with someone rather than running from it. One of the core qualities I carry from healthcare is the belief that clear, effective communication is essential for a true partnership. By being proactive and reaching out when things don’t go as planned, you don’t just solve a problem; you prove you are a partner committed to navigating things together.

What did suffering teach you that success never could?

Losing my mother to cancer while I was in college was a crash course in something success could never have taught me: our time is our most valuable asset. When you’re young and finding your footing, success often makes you feel like you have an infinite runway to reach the next milestone. But suffering stripped that illusion away. It taught me that none of us know the length of our journey or when our time will run out. That realization shifted my perspective; it taught me that we must focus our energy on what truly matters right now, rather than waiting for a “someday” that isn’t guaranteed.

This experience fundamentally shaped the work I do today. While I believe it is good to be productive and work hard, those things shouldn’t come at the cost of the people we love. It’s why I am so passionate about helping my clients reclaim their time. I don’t just want to help them build a larger account balance; I want to create a balanced plan that supports their well-being so they can enjoy life with their family and friends. Wealth is simply the tool we use to protect our most precious resource: our time.

So a lot of these questions go deep, but if you are open to it, we’ve got a few more questions that we’d love to get your take on. Whom do you admire for their character, not their power?

I’ve always admired John “Jack” Bogle, the founder of Vanguard, for prioritizing purpose over profit. In an industry often defined by complexity and high fees, Bogle was a radical outlier who created the first index fund to make investing simple and fair for the average person. Even when the industry mocked his vision as “Bogle’s Folly,” he refused to compromise, eventually establishing a unique structure where Vanguard is owned by its funds; effectively making the investors themselves the owners of the company. He chose to prioritize character over personal power, giving away a potential fortune to ensure that everyday people could keep more of their hard-earned money by minimizing unnecessary costs.

Warren Buffett once noted that if a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. Bogle’s legacy taught us that you don’t have to be the most powerful person in the room to make an impact; you just have to be the one who refuses to compromise on doing what is right for the client. I carry that same philosophy into my own practice.

Okay, so before we go, let’s tackle one more area. If you laid down your name, role, and possessions—what would remain?

If you stripped away my name, my role as an advisor, and everything I own, what remains is a person who thrives on movement, connection, and the simple joys of being present. You’d find a guy who is happiest when he’s active, whether playing sports or just enjoying the outdoors, and someone who believes that a life well-lived is measured by the quality of time spent with family and friends. I’m also someone who has a deep appreciation for great food. If you’re ever in Grand Rapids, Char has the absolute best tacos; every person I have ever taken there has walked away a believer.

Beyond the fun and the food, what remains is a genuine concern for children. I truly believe that so much of who we become as adults is rooted in how we were raised, and it weighs on me that not every child gets to grow up in a stable, supportive environment. My wish is for a world where every kid has that solid foundation. I don’t think we will ever reach that 100%, but I believe we can all make small, intentional efforts to help move the needle.

It reminds me of a quote I love by Danielle Doby: “When you create a difference in someone’s life, you not only impact their life, you impact everyone else influenced by them throughout their entire lifetime. No act is ever too small. One by one, that is how to make the ocean rise.”

Contact Info:

- Website: https://www.forfiduciary.com/meet-heath-biller

- Linkedin: https://www.linkedin.com/in/heath-biller/