Today we’d like to introduce you to Darla Bishop

Hi Darla, it’s an honor to have you on the platform. Thanks for taking the time to share your story with us – to start maybe you can share some of your backstory with our readers?

I grew up in a family where money was often tight, and financial discussions weren’t usually positive. While studying at the University of Michigan alongside well-off classmates, I realized that even though they had financial security, I was just as smart—if not smarter—and I could figure out the money part, too. This mindset pushed me to dive deep into financial literacy, reading over 100 books on budgeting, debt management, and investing, eventually developing my own strategies.

Through this personal journey, I discovered my passion for helping others achieve financial wellness, especially those who, like me, lacked early financial education. That’s when I wrote How to Afford Everything, and developed my signature tool, the Paycheck Playbook™, to simplify the path to financial freedom for others. I also launched Finansis LLC to offer coaching, speaking, and educational materials that support individuals and organizations in their financial wellness journeys.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

It’s definitely been a bumpy road. One of the biggest challenges I’ve faced is the instability that comes with being a military spouse. Frequent relocations and the uncertainty of maintaining a consistent career while moving around made it incredibly difficult to stay on a stable financial path. Each time we moved, I had to start over—finding new work, adjusting to new financial realities, and figuring out how to balance family life alongside everything else.

This instability also meant that my graduate education took much longer than planned. It took me eight years to complete graduate school, as I had to pause and restart my studies while juggling moves, family responsibilities, and financial planning. At times, it felt overwhelming, but those experiences taught me resilience and how to manage finances amid uncertainty.

These struggles have given me a unique perspective on the importance of financial flexibility and planning, especially for people whose lives are constantly in flux. It’s what drove me to create the Paycheck Playbook™—a tool designed to help people build financial stability, even in unpredictable circumstances.

Thanks – so what else should our readers know about Finansis LLC?

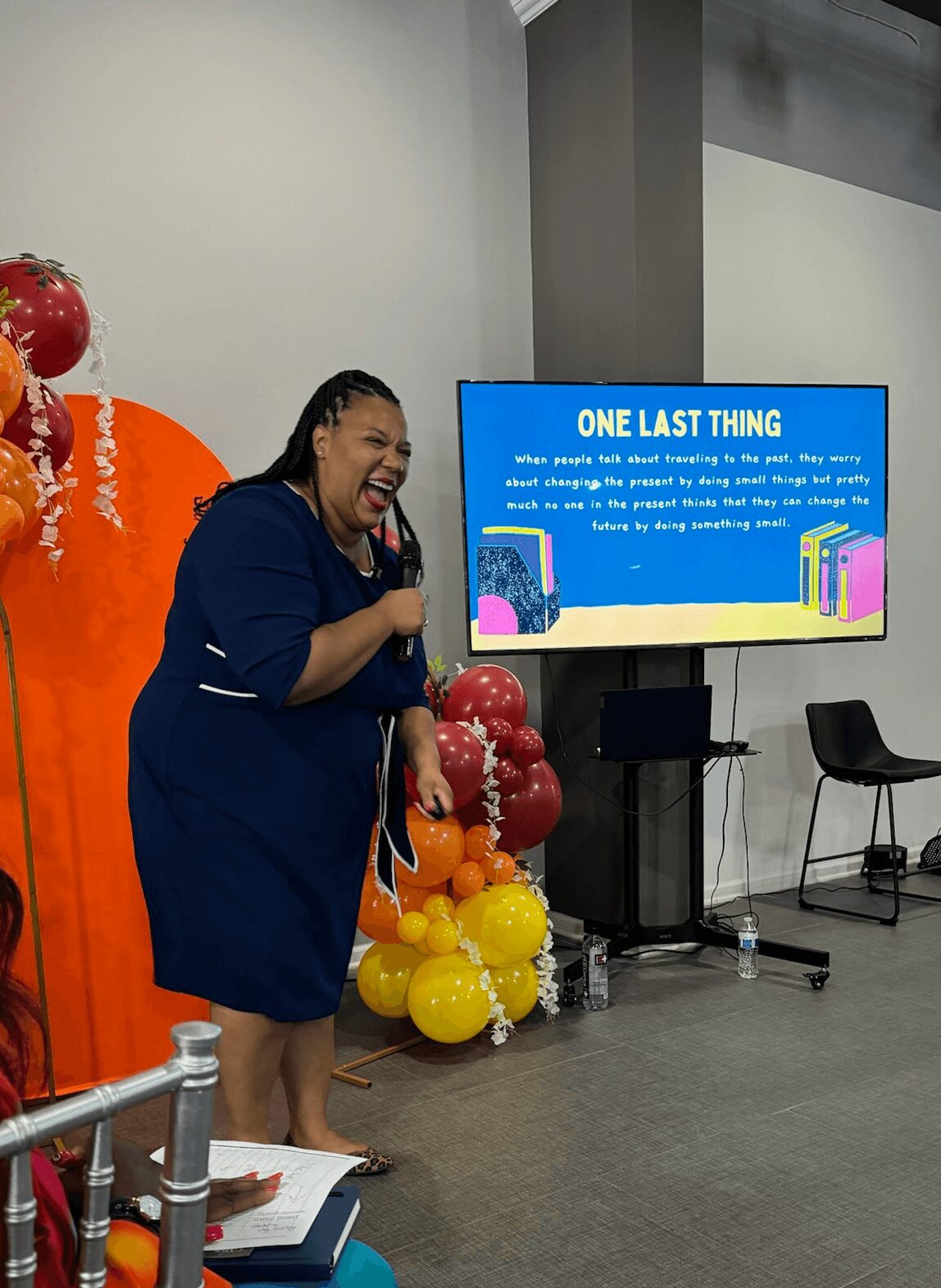

Finansis LLC is a consulting firm based in Lansing, Michigan. I started the company as a way to improve the health of communities via financial literacy education. Our mission is to make financial wellness accessible and achievable for everyone, no matter where they’re starting from. We provide practical tools and education that help individuals and organizations take control of their financial futures. We specialize in helping young adults and first-generation students, particularly those who haven’t had early access to financial education, build the knowledge and confidence they need to thrive financially.

We’re best known for our signature tool, the Paycheck Playbook™, and the accompanying book, How to Afford Everything. These resources break down financial planning into simple, actionable steps, guiding people through budgeting, debt management, saving, and investing in a way that’s easy to follow and implement. What sets us apart is our focus on personalization—recognizing that each person’s financial journey is unique—and our ability to provide tools that adapt to different life situations, whether you’re just starting out, dealing with life transitions, or trying to recover from financial missteps.

I’m most proud of how Finansis has evolved into a trusted resource that not only teaches financial literacy but truly empowers people to make lasting changes in their lives. From one-on-one coaching to group workshops, online courses, and speaking engagements, we provide a wide range of services to meet the needs of our diverse clients. Whether it’s an individual looking to get their finances in order, a business seeking to improve employee financial wellness, or a school aiming to equip students with lifelong financial skills, we’re here to help.

What I’d love for readers to know is that Finansis LLC is committed to simplifying the path to financial freedom. We don’t just provide financial education—we offer a roadmap, tools, and ongoing support to help you reach your financial goals, no matter your starting point.

We’d love to hear about any fond memories you have from when you were growing up?

One of my favorite childhood memories is from my 4th birthday, when my aunt Dinah took me on a special shopping trip. She let me choose any store I wanted to visit, and after I picked out some toys and clothes, we had a wonderful lunch together. It felt so special to have a day that was all about me. But the funniest part happened when we got back to her house—I neatly stacked all my new toys and clothes in the middle of the living room, stood there proudly, and announced that I was ready to go home! We still laugh about it to this day. That memory reminds me of how loved and celebrated I felt, and it’s something I’ve always cherished.

Pricing:

- How to Afford Everything (Paperback) 19.99

- 1:1 Coaching $247/hr

- Custom Workshops $Varies

Contact Info:

- Website: https://howtoaffordeverything.com

- Instagram: https://www.instagram.com/my_finansis/

- Youtube: https://www.youtube.com/@my_finansis

Image Credits

Blake Matthews

Marques Davis